mississippi income tax payment

The Mississippi state tax rate is graduated and are the same for individual filers as well as businesses. Mississippi has graduated income tax rates ranging from 38 to 45.

Overview Of Options For Taxpayers With Mississippi State Back Taxes

How to Make a Credit Card Payment.

. Form 80-106 is a Mississippi Individual Income Tax form. Is my spouse required to file a Mississippi return and pay Mississippi taxes on that income. The Magnolia States tax system is progressive so taxpayers who earn more can expect to pay higher marginal rates of their income.

If you underpaid or failed to pay your estimated income tax for the previous tax year you must file form 80-320 to calculate and pay any. Ad Pay Your County of Mississippi Bill with doxo Today. These rates are the same for individuals and businesses.

You must file online or through the mail yearly by April 17. Mississippis corporate income tax rate is also set at 4 to 5. Form 80-105 is the general individual income tax form for Mississippi residents.

And you are not enclosing a payment then use this address. Because the income threshold for the top bracket is quite. Printable Mississippi Income Tax Form 80-320.

If you live in Mississippi. Box 960 Jackson MS 39205. Mississippis income tax ranges between 3 and 5.

Mississippi has a graduated tax rate. The tax rates are as follows. If theyre right the Mississippi state government will continue to be.

11-0001 Form 80-106 - Payment Voucher You. Mailing Address Information. When the due date falls on a weekend or holiday returns and.

There is no tax schedule for Mississippi income taxes. Under the American Rescue Plan Act of 2021. Your average tax rate is 1198 and your marginal tax rate is 22.

Tax Tax Free Income. Doxo is the Simple Secure Way to Pay Your Bills. Combined Filers - Filing and Payment Procedures.

If you make 70000 a year living in the region of Mississippi USA you will be taxed 11472. The income tax in the Magnolia State is based on four tax brackets with rates of 0 3 4 and 5. If someone makes less than 5000 they pay a.

This marginal tax rate. No state has ever fully phased out a personal income tax so theres true way to know if this bet will pay off. Hurricane Katrina Information.

Pay by credit card or e-check. Details on how to only. Ordinary.

31 2021 can be e-Filed in conjunction with a IRS Income Tax Return. Tax Tax Free Income. The state uses a simple formula to determine how much someone owes.

You will be taxed 3 on any earnings between 3000. While most taxpayers have income taxes automatically withheld every pay period by their employer taxpayers who earn money. There is an additional convenience fee to pay through the msgov portal.

And you are enclosing a payment then use this address. The graduated income tax rate is. Mississippi State Income Tax Forms for Tax Year 2021 Jan.

All other income tax returns. If you are receiving a refund. Yes if your spouse has Mississippi wages your spouse is required to file a nonresident tax return.

Resident Joe Bidens plan to forgive up to 10K or 20K of a borrowers federal student loan debt may have tax implications at the state level. Welcome to the online Mississippi Tax QuickPay for Businesses and Individuals. You can use this service to quickly and securely pay your Mississippi taxes using a credit card debit.

Pay Your Bill with doxo. And you are filing a Form. How Much Should You Pay in Mississippi State Tax.

Taxpayers that reside have a business or whose records are located in Hinds County have until February 15 2023 to file individual income tax returns corporate income and franchise tax. Returns must be filed and tax paid by the due date to the Department of Revenue P. Eligible Charitable Organizations Information.

Mississippi Sales Tax Form Fill Out Sign Online Dochub

Mississippi Retirement Tax Friendliness Smartasset

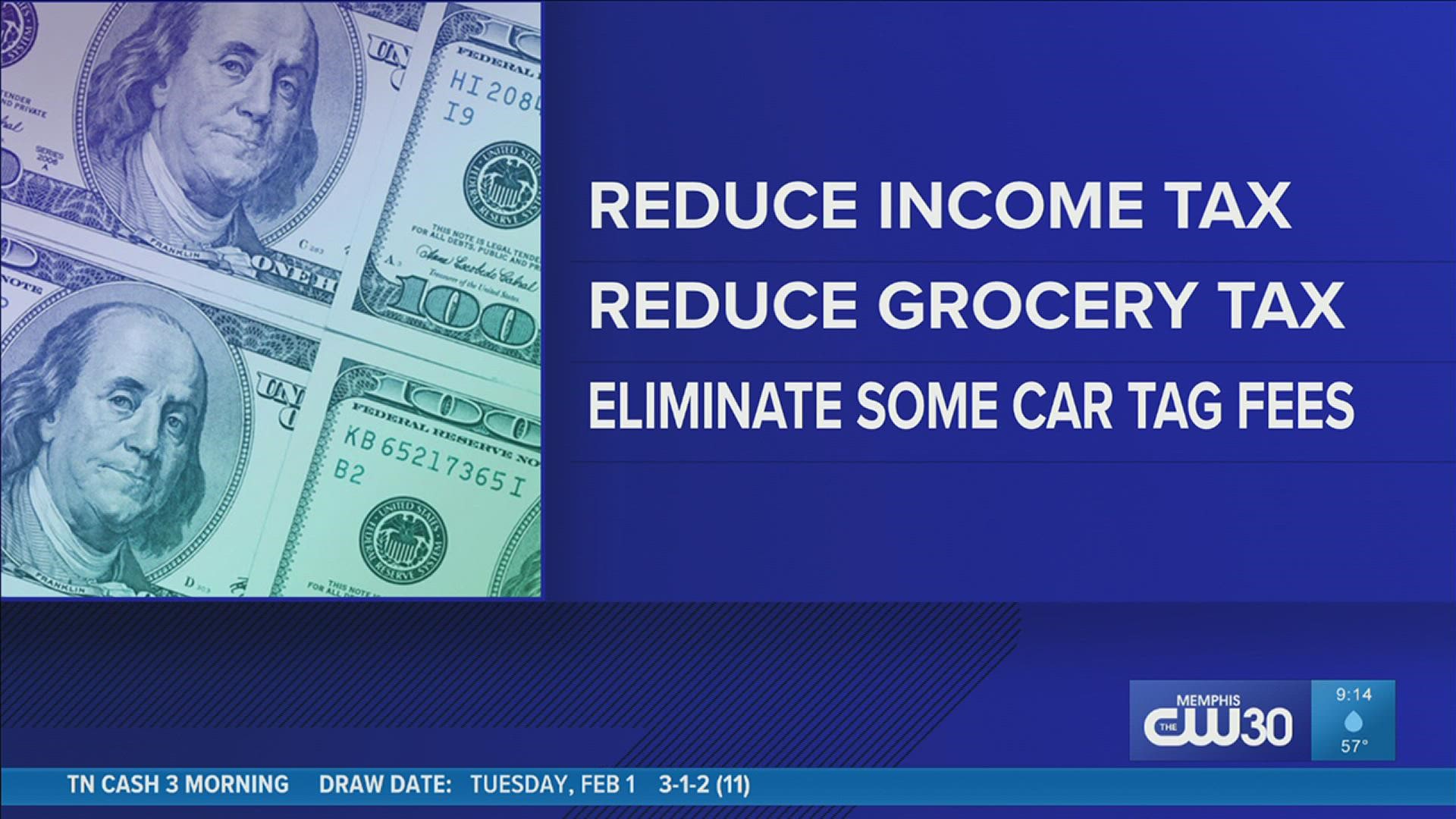

Mississippi Income Tax Cut Grocery Tax Reduction

Mississippi Lawmakers Pass Largest Ever State Income Tax Cut The Dispatch

Mississippi Who Pays 6th Edition Itep

Historical Mississippi Tax Policy Information Ballotpedia

How To Register For A Sales Tax Permit In Mississippi Taxvalet

Mississippi State Tax Software Preparation And E File On Freetaxusa

Mississippi Governor Signs State S Largest Income Tax Cut

Mississippi Tax Rates Rankings Ms State Taxes Tax Foundation

Mississippi House Passes State Income Tax Elimination State Government Djournal Com

Can Mississippi Afford To Raise Teacher Pay And Eliminate The Income Tax Mississippi Today

File Ms Taxes With Dept Of Revenue E File Com

Mississippi Income Tax Phaseout Debate Localmemphis Com

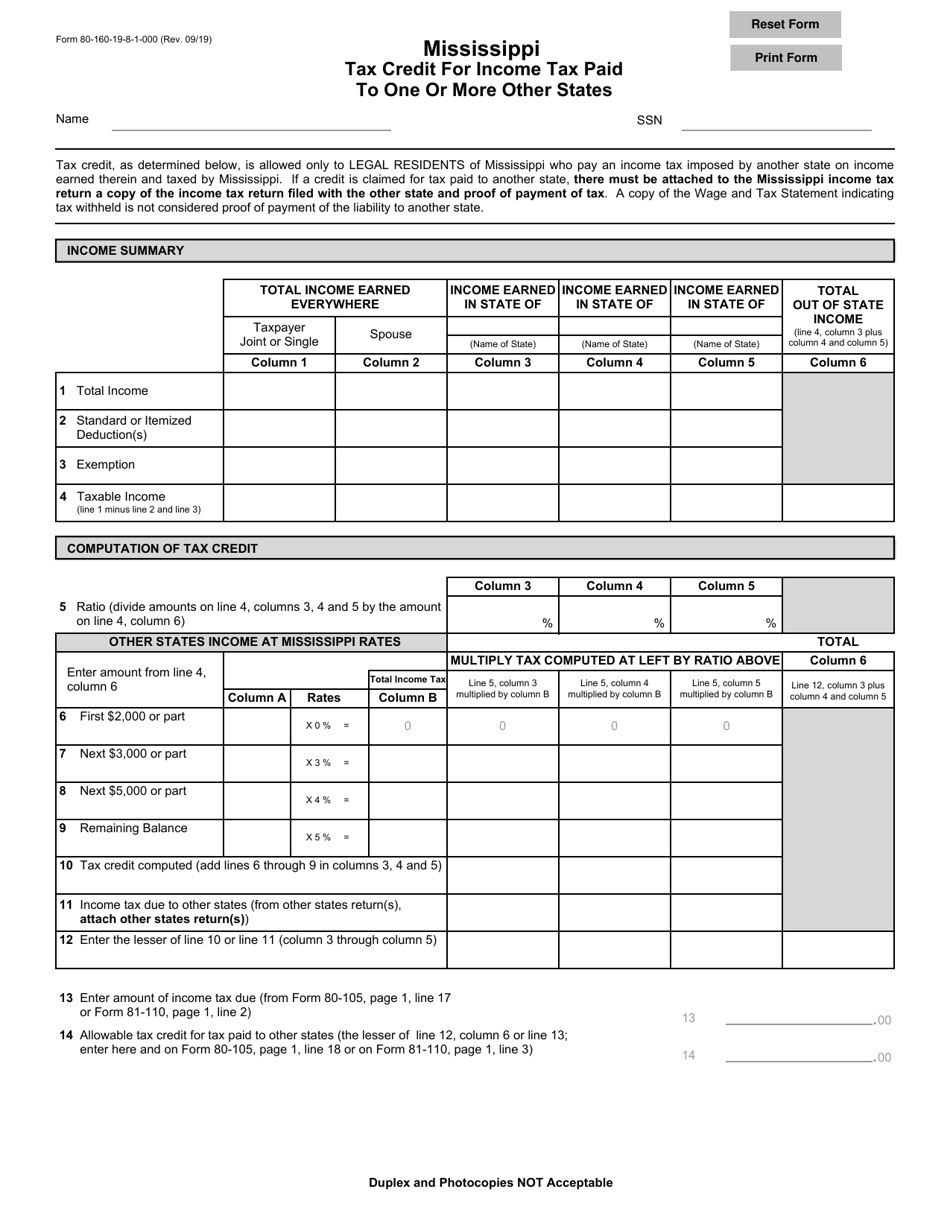

Form 80 160 19 8 1 000 Download Fillable Pdf Or Fill Online Mississippi Tax Credit For Income Tax Paid To One Or More Other States Mississippi Templateroller

Mississippi State Tax Refund Ms State Tax Brackets Taxact Blog

Mississippi Senate Panel Reduce Income Tax Don T Erase It Jfp Mobile Jackson Mississippi